Canadian Household Debt

December 19, 2011 by staff · Comments Off on Canadian Household Debt

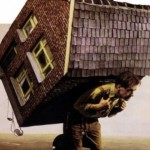

Canadian Household Debt, Canadian households are drowning in debt. According to a new report released Tuesday, Canada’s household debt has reached a record high in part to stagnant income and individuals taking on more debt.

Canadian Household Debt, Canadian households are drowning in debt. According to a new report released Tuesday, Canada’s household debt has reached a record high in part to stagnant income and individuals taking on more debt.

On Monday, head of the Bank of Canada, Mark Carney, reiterated his worries on household debt. Carney said during a speech in Toronto that “debt-fuelled” consumer spending must be replaced with businesses investing in emerging markets.

One day later, Statistics Canada released a report on the third quarter of the year, which highlights increased household debt. According to the new report, the ratio of debt to personal disposable income – the measurement of a consumer’s position – is 152.98 percent, up from 150.57 percent last quarter.

Much of Canada’s consumer debt stems from stagnant income and those piling on debt. Debt burdens have exceeded the levels in the United States and the United Kingdom. Mortgage credit rose to $1 trillion, while consumer debt increased to $448 billion.

Furthermore, the report suggested that household net worth in the third quarter declined by 2.1 percent, which is the second straight decrease. Per capita household stands at $180,100, down from $184,700.

“National net worth increased 1.0% to $6.5 trillion in the third quarter, a slower pace than in the second quarter,” the report noted. “On a per capita basis, national net worth rose to $189,100 in the third quarter, up from $187,900 in the previous quarter.”

Overall government net debt is up to $795 billion from $772 billion in the second quarter. Meanwhile, the ratio of government debt to gross domestic product was up from 46.3 percent in the last quarter to 46.9 percent in the third.

“Provincial bonds were the primary contributor to the increase in total government debt in the third quarter, augmented by higher levels of federal bonds and short-term paper,” said the statistics agency in the report.